Table of Content

Automate regular transfers to this savings account, and avoid taking money out of the account for anything other than a down payment. Veterans Affairs loans — Current service members, eligible veterans and surviving spouses may be able to get a mortgage with a low, or even no, down payment without having to pay PMI. Compensation may factor into how and where products appear on our platform .

The PMI goes away once the mortgage is under 80% of the purchase price of the home. Down payment assistance is just one type of program available to help you own your first home. Explore other first-time homebuyer programs to make sure you don’t overlook any of your options. For more, read about how much you should put down or the average down payment next.

Diverse business resources

But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. It will help you determine what size down payment makes more sense for you given the loan terms. Another way you could potentially afford a home with less savings is through special HUD programs like Good Neighbor Next Door and Dollar Homes. These programs offer homes at steep discounts, but they’re only available for homes in specific areas, and not every buyer qualifies. So if you’re planning to go this route, make sure you carefully research these options and work with an experienced real estate team.

Some of the offers on this page may not be available through our website. As such, it's essential that you take the time to build your credit history before you start the mortgage process. Start by checking your credit score and reviewing your credit report to learn how well your credit history stacks up and take steps to address potential issues. With an Experian CreditWorks℠ Premium subscription, you can view the same credit scores lenders use, which will equip you well to take action to get the best rate. And while there are home loan programs with no down payment requirement, it's still a good idea to put some money down to avoid being underwater on your mortgage if home prices fall. 10 tips for first-time homebuyers Buying a home for the first time is a new experiences.

Treasury & payment solutions

Do not assume you cannot afford a down payment just because nobody in your family ever owned a home. Also, be aware that demanding an overly high down payment can be a sneaky way to discriminate against minorities. PMI is insurance that protects the lender if a borrower defaults, which is when a borrower can't make any more payments.

Thankfully, there are tons of programs out there to help regular homebuyers achieve home ownership, even if they don’t have anywhere close to 20% saved up. Chelsea Levinson, JD, is an award-winning content creator and multimedia storyteller with more than a decade of experience. She has expertise in mortgage, real estate, personal finance, law and policy. As a result of the more stringent income requirements, would-be borrowers may need to get a part-time job to supplement their income. The extra money should be placed in a savings vehicle to be used only for the down payment.

Ask for a Gift From Family

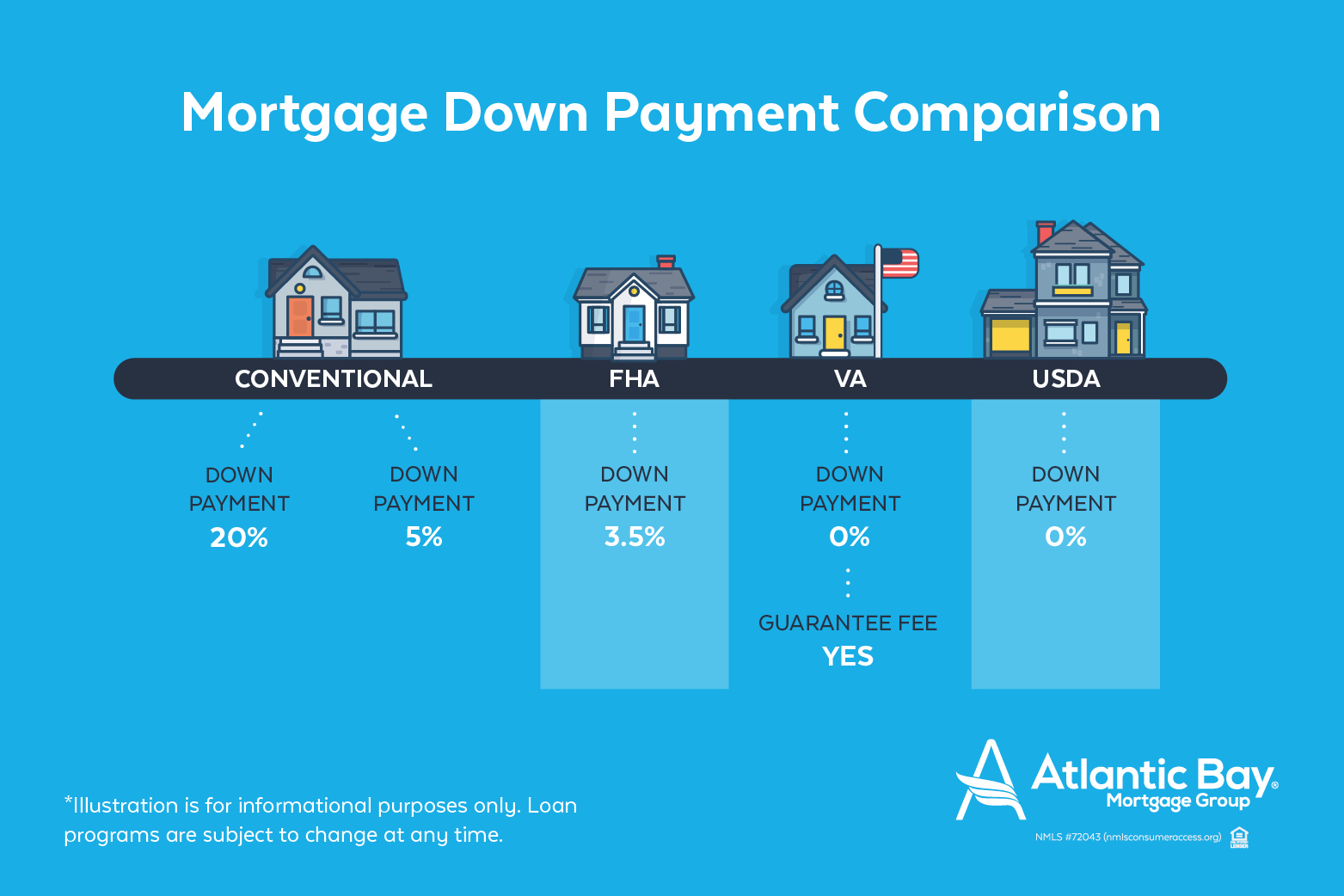

There are also plenty of first-time home buyer programs that let you put down as little as 3.5% or even 0%, and you can often qualify as long as you haven't owned a home in the last three years. The real cost of using your retirement accounts isn't the taxes or interest you pay but that those funds aren't growing for your retirement. The more aggressively you're invested, the greater that opportunity cost is likely to be. On the other hand, you have to weigh that against the value that owning a home can add as an asset that you can later sell or borrow against to help provide for your retirement. Federal Housing Administration loans — FHA loans are available to borrowers who are putting down as little as 3.5%, but they require mortgage insurance. Apply for a mortgage with a lender who is approved to work with the grant program.

There were also other qualifications buyers needed to meet, including citizenship, income, and residency requirements. It’s possible to buy a house with no down payment using select mortgage programs. However, you likely need cash in your bank account to pay for upfront closing costs. In addition, banks want to see that you can afford your future mortgage payments.

Can I get a down payment loan for a house?

Alternatively, if you qualify for down payment assistance, the funds can often be used for closing costs as well. However, most down payment grants aren’t large enough to cover both the down payment and loan fees in full, so expect to pay to least part of your closing costs out of pocket. However, lender-paid closing costs typically come with higher interest rates.

Your house might be the single biggest purchase you ever make, but it won’t be the only big-ticket item you ever buy. Unless you can comfortably live without a car, you’re likely to buy a new or used vehicle every few years. Once you’re ensconced in your home, you’ll probably want to make sensible improvements that enhance its value or accommodate your growing family. And, all the while, you need to have enough set aside for the unexpected. Mint is one of the oldest and best-known of the many personal budgeting apps available to U.S. consumers. It has a slew of capabilities designed to increase your understanding of your personal finances, categorize your spending and saving, and become more financially fit overall.

There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question“how much should my down payment be? There are also several conventional loan programs geared toward first-time and low income buyers, including Fannie Mae HomeReady and HomePath Ready Buyer, and Freddie Mac HomeOne and Home Possible. Some of these DPA loans have deferred payments until you sell or refinance the home, and others are forgiven completely once you’ve lived in the home a certain number of years. Plus, many of these down payment-oriented second mortgages feature low- or no-interest options. So, if you plan to stay put for a bit, a second mortgage might be a solid option for you.

Though it’s due at closing, the down payment usually isn’t considered a closing cost. Your down payment plays an important and sometimes decisive role in whether you can close on your dream house – or, let’s be real, the best house you can afford on your budget. To qualify for down payment assistance, you must have not owned a home in the past three years. You must also show proof of a credit score 620 or higher, a steady income, and a healthy debt-to-income ratio. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford.

The Veterans Affairs Department is an agency of the U.S. government. A VA loan is a mortgage loan that is available to current and former members of the military , issued by banks and other commercial lenders but guaranteed by the VA against a borrower’s default. VA loans make home ownership more possible for borrowers than it otherwise would be through conventional mortgage loans, primarily because a VA loan does not require any down payment. Additionally, interest rates offered for VA loans often turn out to be lower than those offered for conventional loans. If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance. You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan.

No comments:

Post a Comment