Table of Content

You can get up to 4% of the loan amount in cash.Cash assistance comes via a second mortgage that is forgiven after four years unless you trigger a repayment event . To be eligible, you must demonstrate creditworthiness and finish a homebuyer education class. Especially for first-time homebuyers, it can be hard to save up enough money for a substantial down payment. Down payment assistance programs help fill that gap by covering all or part of the cost. When looking for programs to apply for, research their requirements, understand whether it's a grant or loan, and get specifics on how much assistance you can receive. No matter what, with the right knowledge and resources, buying a home can be within your reach.

Gifters, even family, will need to provide paperwork in the form of a gift letter. For example, you’ll have to wait about 90 to 120 days before you can use any of those funds. The more money you can put down on your new home, the less you'll have to borrow. This not only ensures that you'll have a lower monthly payment but it can also help you qualify for a lower interest rate.

Down Payment Assistance Programs

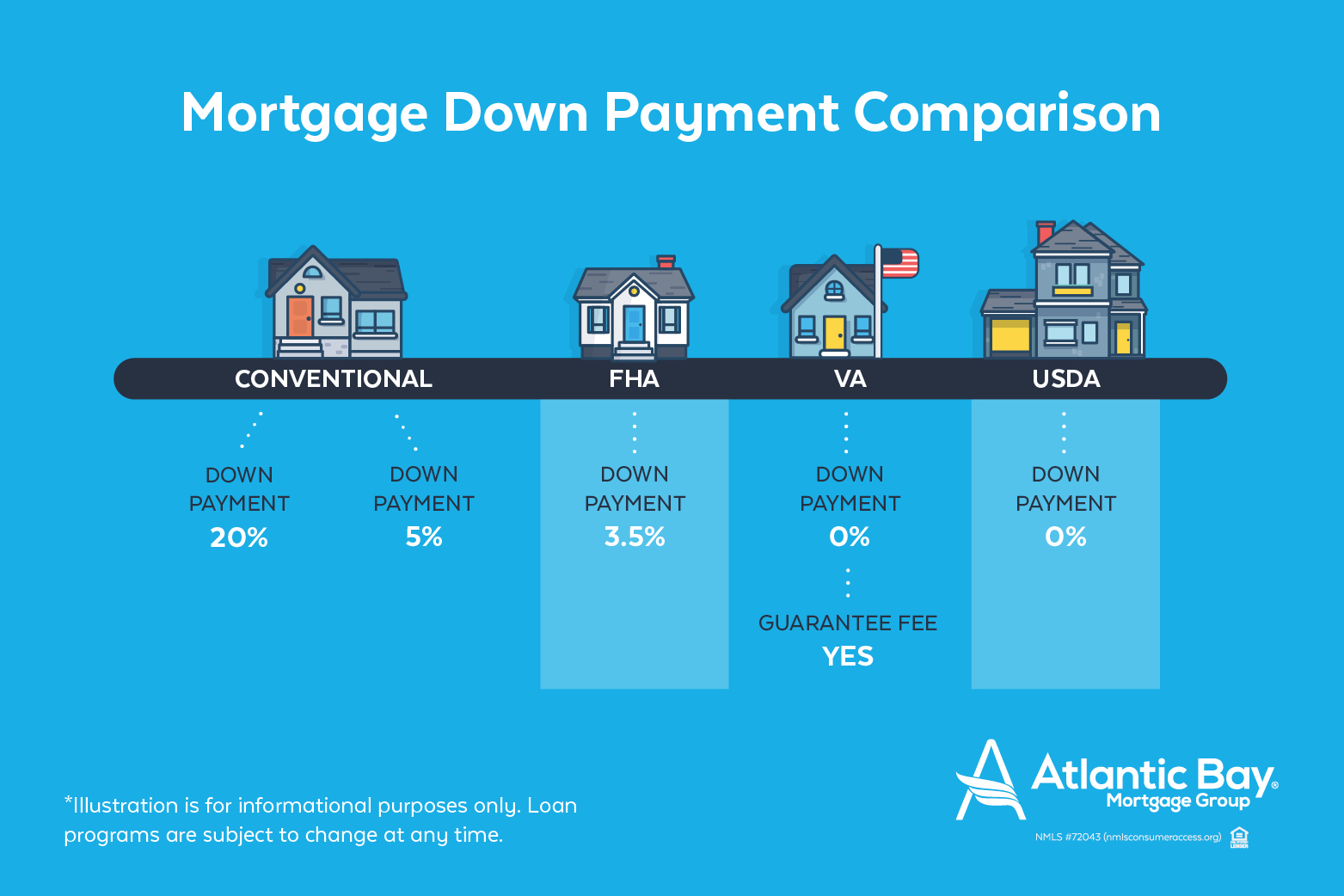

For new homeowners already trying to adjust to the many costs involved in homeownership, tax credits offer welcome relief. They can often point you in the right direction for lenders who are a good fit, connect you to useful resources, and generally help you navigate what can be a complex journey. You can find a real estate agent through family and friend recommendations or real estate websites such as Realtor.com. Fortunately, there are a variety of ways to get help with your closing costs. Some home buyers believe you need 20% down on a conventional loan. In reality, though, conventional programs start at just 3% down.

A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

How to sell and buy a house at the same time

For example, it's possible to use a second mortgage, a piggyback loan or even a loan from a friend or family member, but you can't use a personal loan or a credit card cash advance. Whenever you borrow for a down payment, however, be sure to keep an eye on how it impacts your debt-to-income ratio, which is something your lender will consider when approving your loan. Second, there arelimitson how much you can borrow based on where you live.

In Southwest Montana, the Human Resources Development Council can provide down payment assistance to qualified first-time homebuyers in Gallatin, Park and Meagher counties. North CarolinaThe North Carolina Housing Finance Agency’s Community Partners Loan Pool provides funding for down payment assistance. It’s important to know that DPA programs come and go with available funding. For the most up-to-date program requirements, it’s best to contact your local housing authority directly. In addition to regional programs, cities and counties can offer DPA.

What Will the Housing Market Look Like in 2023? A Buyer’s Guide

There are also plenty of first-time home buyer programs that let you put down as little as 3.5% or even 0%, and you can often qualify as long as you haven't owned a home in the last three years. The real cost of using your retirement accounts isn't the taxes or interest you pay but that those funds aren't growing for your retirement. The more aggressively you're invested, the greater that opportunity cost is likely to be. On the other hand, you have to weigh that against the value that owning a home can add as an asset that you can later sell or borrow against to help provide for your retirement. Federal Housing Administration loans — FHA loans are available to borrowers who are putting down as little as 3.5%, but they require mortgage insurance. Apply for a mortgage with a lender who is approved to work with the grant program.

While you aren’t required to cover the entire purchase price up front, you do need to come up with a substantial cash sum before you canclose on your house. Many first-time buyer programs require you to attend a homeowner education course before awarding you any funds. You’ll be advised about any required first-time buyer education during your application process.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

The biggest pro of getting down payment assistance is the possibility of receiving free money or low-cost financing to help offset the expense of a large down payment. Interest rates on down payment assistance loans can be as low as 0%, and the debt may even be forgiven in certain instances. You are free to contribute more than the minimum down payment amount if you want. For instance, one down payment assistance loan in New York City can offer up to $100,000 for eligible buyers, while another in Arkansas may offer just $1,000.

Having enough cash on hand to easily cover your down payment, closing costs and any additional expenses can also make you a more competitive homebuyer. On the other hand, there are buyers who qualify for down payment assistance programs and choose to accept the higher mortgage interest rates. This allows them to purchase a home sooner while they benefit from lower out-of-pocket expenses in the short run. Some buyers who find themselves in this situation choose to delay their home purchase. When buyers save for the down payment on their own, they often get a better mortgage interest rate independent from down payment assistance programs.

So even if you’re eligible for no down payment, having a zeroed-out account balance would hurt your chances of qualifying for a mortgage. The federal government offers a few down payment assistance programs. The Chenoa Fund, available through CBC Mortgage Agency, helps homeowners cover up to 3.5% of their down payments. Depending on your credit score and income, you can receive a grant, a forgivable second mortgage or a regular second mortgage.

Lastly, don’t completely deplete your bank account to buy your dream home. It’s wise to have at least three months’ income in liquid savings as anemergency fund, regardless of your near- or long-term goals. The top end of your affordability range, then, is the highest down payment you can save for within your allotted time horizon, without undershooting your target LTV.

For those looking to buy a home, PMI insurance adds to the monthly outlay of cash for payments. PMI payments are non-recoverable expenses that do not pay down the principal balance of your mortgage. On the other hand, coming up with 20% of a home's purchase price may take years to save up for, especially in hotter real estate markets. If you get a conventional loan, down payment assistance funds could save you a lot in mortgage insurance premiums over time.

The Home in Five Advantage program, available in Maricopa County, provides funds through a silent second mortgage. ArizonaThe Arizona Department of Housing lists several homeownership assistance options. Statewide, the Home Plus program is available to buyers who make less than $105,291 per year.The Pima Tucson Homebuyer Solution Program is available throughout Pima County. DPA and settlement assistance programs are also available in New Castle County and for city employees in Wilmington. In partnership with the City of Central Falls, Pawtucket Central Falls Development assists eligible first-time homebuyers in Central Falls.

You’re essentially rolling the cost into your mortgage loan when you go this route. As we mentioned above, your down payment isn’t the only upfront cost when buying a home. These cover lender fees and third party fees required to set up your home loan . Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information.

No comments:

Post a Comment